Alright, let's get down to it. To study in Canada, you'll need to show you have CAD $20,635 set aside just for your living expenses. This is on top of whatever you need for your first year of tuition and your travel costs.

Think of it as a financial safety net. The Canadian government wants to see that you can support yourself comfortably without scrambling for money, so you can actually focus on your studies. It's a practical step to ensure you start your journey on the right foot.

Why Does Canada Ask for Proof of Financial Support?

Before you can even think about hitting the books in Canada, you've got to prove you have the funds to back up your dream. It might feel like just another hoop to jump through, but Immigration, Refugees and Citizenship Canada (IRCC) has a good reason for it.

This isn't meant to be a barrier. It’s their way of making sure you won't face financial hardship once you arrive. By confirming you can cover your costs, they're helping ensure you can dedicate all your energy to your education, which is the whole point, right? It's about giving every international student a fair shot at success from day one.

Getting to Grips with the Updated Numbers

The financial goalposts for students can and do move. As of 2025, the minimum bank balance needed for a single student (outside of Quebec) has jumped significantly. The cost-of-living part of the equation went from around CAD $10,000 to a much higher CAD $20,635 a year.

Remember, this amount is separate from your tuition fees and travel expenses, which you also have to prove you can cover. You can find more details on this recent hike in student visa financial requirements on gyandhan.com.

When you show you meet this minimum bank balance, you're essentially telling the visa officer, "I'm prepared, I'm responsible, and I'm ready to thrive as a student in Canada."

So, what does this magic number cover? It’s calculated to handle all the basic necessities, including things like:

- Your accommodation or rent

- Groceries and food (you gotta eat!)

- Transportation to and from campus

- Utilities and other daily bits and pieces

Meeting this financial requirement isn't just a suggestion—it's a non-negotiable part of a successful visa application.

How To Calculate Your Required Total Funds

Figuring out the exact bank balance you need for your Canada student visa can feel a bit like cracking a code, but it’s actually more straightforward than you might think. It really just comes down to a simple calculation.

Think of it as adding up three key pieces of a puzzle. Once you know what they are, you can confidently calculate the total amount that Immigration, Refugees and Citizenship Canada (IRCC) wants to see.

The Three Essential Financial Components

Your total required funds are simply the sum of three distinct costs. You'll need to account for every single one to present a complete and convincing financial picture to the visa officer.

Here’s the breakdown:

- Living Expenses: This is a fixed amount set by the IRCC. For a single student, you must show you have CAD $20,635 put aside just to cover your living costs for one year. No more, no less.

- First-Year Tuition Fees: Now, this number will be different for everyone. It depends entirely on your chosen university and programme. You have to prove you can cover the full tuition fee for your first year, exactly as it’s written on your Letter of Acceptance. You can get a better sense of how international student fees in Canada are structured to help you estimate.

- Travel Costs: Don't forget, you also need to get to Canada! While there's no official number for this, a safe bet for a one-way flight from India is somewhere between CAD $1,500 and $2,000.

Having all your financial documents, like your bank statements, perfectly in order is a critical step before you even think about applying.

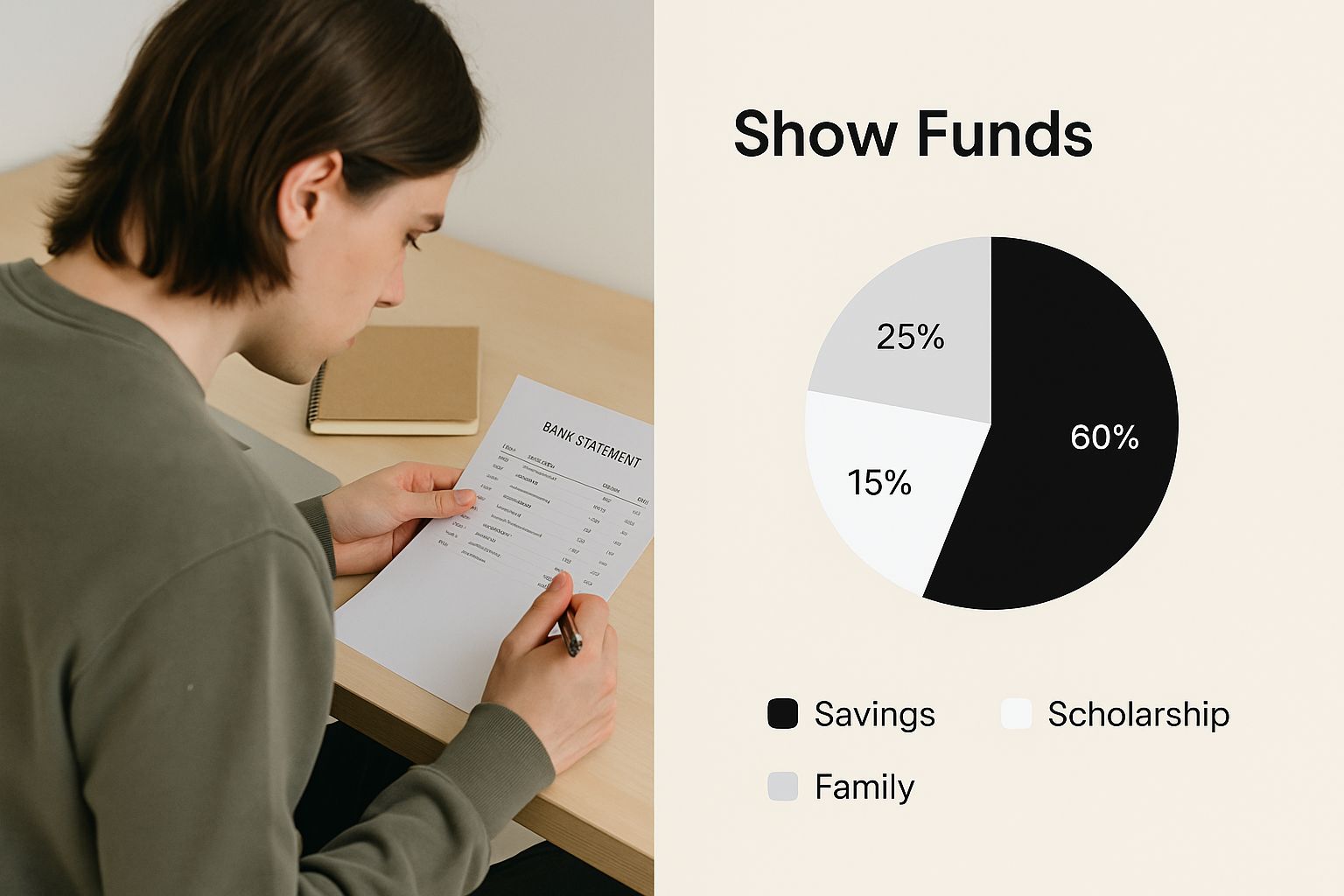

Ultimately, this visual just reinforces the point that showing proof of sufficient funds isn’t just a suggestion—it's a non-negotiable part of the visa process.

So, let's put this all together and see what it looks like in the real world.

Sample Calculation for Your Required Bank Balance

Here’s a quick table to show you how the numbers add up. I’ve included two scenarios to show how a different tuition fee can change the final amount you need.

| Expense Component | Amount (Average Tuition Scenario) | Amount (Higher Tuition Scenario) |

|---|---|---|

| Annual Living Expenses | $20,635 | $20,635 |

| First-Year Tuition Fee | $22,000 | $28,000 |

| Estimated Travel Costs | $1,800 | $1,800 |

| Total Required Funds | $44,435 | $50,435 |

By following this simple addition, you can figure out precisely what your target bank balance should be. No guesswork required

Showing Them the Money: How to Prove Your Financial Support

Alright, so you've done the maths and figured out how much money you need. What's next? You have to prove it. Immigration, Refugees and Citizenship Canada (IRCC) needs to see cold, hard proof that you have the funds ready to go. Think of it less like a simple bank check and more like presenting a solid financial portfolio to the visa officer.

There are a few ways to do this, and honestly, some are much stronger than others. Each method tells a story about how prepared you are, so picking the right one is a big deal for building a strong application.

The Gold-Standard Methods

For most students, especially if you're applying through the faster Student Direct Stream (SDS), IRCC has its favourites. These are the methods they trust the most because they leave very little room for doubt about your financial situation.

Guaranteed Investment Certificate (GIC): This is pretty much the top-tier option. You buy a GIC from a Canadian bank for CAD $20,635. It’s like a financial handshake; it proves you’ve already moved your living expense money into Canada. It screams commitment and wipes away any questions about how you'll cover your day-to-day costs when you land.

Education Loan Sanction Letter: Taking out a loan to fund your dream? Perfect. The official sanction letter from your bank is your proof. This isn't just any letter; it has to clearly lay out the loan amount, the terms, and state that the money is specifically for your Canadian education. It's a straightforward and widely accepted way to show you've got the financial muscle.

Other Ways to Prove Your Funds

While a GIC or a loan letter are your best bets, they aren't the only game in town. You can use your personal savings or have a sponsor back you up, but be warned: these routes require a lot more paperwork to be convincing. For a deeper dive, our guide on financial aid options for studying abroad has some great insights.

Proving your funds isn't just about hitting a minimum bank balance for a Canada student visa. It's about showing the visa officer that you're responsible, well-prepared, and ready to thrive as a student.

If you’re going the savings route, you'll need to hand over official bank statements from the last four to six months. This history is critical. It shows the money has been sitting there for a while and wasn't just dropped into the account last week to meet the requirement.

On the other hand, if a sponsor like your parents is footing the bill, you'll need an affidavit of support. This is a formal legal document, and it must be backed up with their bank statements and proof of income. This confirms they not only have the money but also have the genuine intention to support your studies.

Telling a Clear Story with Your Bank Statements

Think of your bank statements as more than just a list of transactions; they're telling the visa officer a story about your financial reliability. They aren't just looking for the final number at the bottom of the page. They're reading the narrative of how you've built up the funds for your Canadian education. A clean, easy-to-follow story builds a massive amount of trust.

This means you need to show a clear financial history for at least the last four to six months. The goal is to demonstrate a consistent pattern of savings or stable, long-held funds. If you suddenly deposit a huge chunk of money right before applying, it raises a red flag. This is often seen as 'fund parking,' a tactic that can seriously damage your application's credibility.

Making Your Documents Official

Let's be clear: a quick printout from your banking app or a simple screenshot just won't cut it. Every single page of your bank statement has to be official, no exceptions.

What does "official" mean? It has to be:

- Printed on the bank's own letterhead.

- Stamped by a bank official on every single page.

- Signed by an authorised person from the bank.

These small details are non-negotiable. They are the official verification that confirms your documents are authentic and trustworthy.

Think of your bank statements as your financial resume. A clean, consistent, and well-documented history gives the Canadian authorities confidence that you are a responsible and well-prepared applicant, ready for your educational journey.

Bank statements are a critical piece of the proof of funds puzzle for Canadian immigration, especially for us applicants from India. IRCC wants to see these recent statements to confirm you have the financial muscle to cover your expenses, which includes the CAD $20,635 minimum for living costs. These helpful insights from Axis Bank offer a great overview of how these requirements function. A clear financial story, backed up by properly authenticated documents, is absolutely essential. For more tips on managing your money, check out our guide to creating a student living budget in Canada.

Common Financial Mistakes That Risk Visa Rejection

Getting the minimum bank balance right for your Canada student visa is a huge step, but unfortunately, one simple slip-up in your financial documents can bring everything to a halt. Knowing the common tripwires is honestly your best defence against a rejection letter.

One of the biggest red flags for visa officers is something called ‘fund parking’. Imagine this: a huge chunk of money suddenly lands in your account right before you apply. To an officer, this looks suspicious, like the money was just borrowed to tick a box and isn't genuinely available for your studies. It immediately casts doubt on your entire financial story.

Avoiding Preventable Errors

Another classic mistake is trying to use assets you can't spend easily. The money you show has to be liquid and ready to go—think cash sitting in a savings account or a Guaranteed Investment Certificate (GIC).

Your financial story needs to be simple, stable, and transparent. Any hint of inconsistency or last-minute scrambling can undermine the visa officer's confidence in your application.

Here are a few other blunders I’ve seen trip people up time and again. Make sure you steer clear of them:

- Submitting Incomplete Documents: Every single page of your bank statement needs an official stamp and signature. Don’t even think about sending unofficial printouts or missing pages; they’ll be dismissed straight away.

- Using Non-Liquid Assets: Showing property deeds or a stock portfolio won't cut it. IRCC needs to see cold, hard cash that you can access immediately to pay for your tuition and living costs.

- Mismatched Information: Your name, address, and every other personal detail must be exactly the same across all your documents. A tiny spelling mistake or a different address on your bank statement can create huge headaches.

- Ignoring the History: Just showing the final balance isn't enough. You have to provide a clear financial history for at least four to six months to prove the funds have been stable and are truly yours.

By carefully sidestepping these common pitfalls, you make sure your financial proof is rock-solid. It’s all about painting a clear, trustworthy picture for the Canadian authorities.

Keeping Up with Canada's Evolving Financial Rules

One thing you can count on with Canadian student visa rules is that they change. The financial goalposts are always moving to keep up with the country's economy, which is why that five-year-old blog post you found is probably the worst source of advice. Trusting outdated info is a surefire way to get an avoidable visa rejection.

Immigration, Refugees and Citizenship Canada (IRCC) regularly reviews and adjusts the cost-of-living requirements. This means the minimum bank balance for a Canada student visa can tick upwards from one year to the next. The only place you should be getting this number from is the official Government of Canada website. Seriously, bookmark it.

Staying Ahead of Policy Changes

The government tweaks these financial thresholds to match inflation and the reality of living costs in Canada. For instance, we already know the living expense requirement will jump again for any applications submitted from September 1, 2025, rising to CAD $22,895 for a single student. You can read more about how these Canadian study visa requirements are evolving on greentreeimmigration.com.

Always, always double-check the current proof of funds number directly on the IRCC website before you even think about finalising your documents. It’s the single easiest step you can take to protect your application from being tossed out on a simple technicality. You've worked too hard for that.

Got Questions About Proof of Funds? Let's Clear Things Up

Figuring out the money side of your Canadian student visa application can feel like a maze. Honestly, it brings up a ton of questions for everyone. So, I’ve put together some quick, straight-to-the-point answers to the things students ask most often.

Can My Parents (or Someone Else) Sponsor Me?

Yes, absolutely! Having a sponsor, like your parents, is incredibly common and totally fine. The key is to make it official. You'll need a formal affidavit of support, which is often just called a sponsorship letter, along with their financial documents. This means showing their bank statements for the last four to six months and proof of their income to demonstrate they can actually afford to support you.

Basically, you need to convince the visa officer that your sponsor not only has the money but genuinely intends to use it to fund your education and life in Canada.

Is Getting a Guaranteed Investment Certificate (GIC) a Must?

A Guaranteed Investment Certificate (GIC) isn't a hard-and-fast rule for every single applicant. However, if you're applying through the popular Student Direct Stream (SDS), then yes, it's mandatory. For everyone else, it’s just considered one of the strongest, most reliable ways to show you have the money.

Think of it this way: a GIC of CAD $20,635 is like telling the visa officer you're so committed that you've already parked your first year's living expenses in a Canadian bank. It really boosts their confidence in your application and quiets any doubts about your financial readiness.

Do I Need to Show Money for My Entire Degree?

Nope, you only need to show proof of funds for your first year of study. That's it. The calculation is simple: your full tuition fee for the first year, plus the standard one-year living expense amount, which is CAD $20,635.

You don’t have to prove you have the cash for a three or four-year programme right at the start. The focus is strictly on your ability to support yourself for those first twelve months.

Can I Use Property or Investments as Proof of Funds?

This is a tricky one. Immigration, Refugees and Citizenship Canada (IRCC) wants to see liquid funds—meaning cash that you can access right away. Things like property valuations, stocks, or mutual funds don't really work because their value fluctuates and you can't turn them into cash in a snap.

The best move? It's strongly recommended to sell off these kinds of assets and get the money into your bank account at least four to six months before you apply. This shows the funds are stable, settled, and ready when you need them.

Navigating all these rules can feel overwhelming, but you don't have to figure it all out on your own. BigUniversities offers expert guidance on everything from picking a university to getting your visa documents in perfect order. We're here to make sure your journey to studying abroad is as smooth as possible. Start planning your future today with BigUniversities.

Article created using Outrank